Table of Content

The establishments on the list have constantly had a few of the best rates of interest, whether or not variable or fixed. ²Round Ups mechanically round up debit card purchases to the closest greenback and transfers the spherical up out of your Chime Checking Account to your savings account. As you store around, use a financial savings calculator to estimate how much interest you can earn with varied financial savings accounts. We also considered whether there have been advanced tier structures or necessities to earn the APY.

Saving for main expenses is another aim a high-interest financial savings account might help you accomplish. Significant life events like retirement, post-secondary education, getting married or shopping for a house can require a healthy stack of cash. The larger yields offered by HISAs might help you build that stack a little faster. An emergency fund is cash you set aside specifically for these unexpected life events that require fast cash. Urgent medical points, automotive repairs and storm harm to a roof or basement are just a few examples of sudden costs that your bank card might not be able to cowl. A financial savings account is a critical component of a well-rounded financial portfolio.

Tab Financial Institution Enterprise Financial Savings

Michael Rosenston is a fact-checker and researcher with experience in enterprise, finance, and insurance coverage. A TFSA GIC can forestall you from having to pay taxes on the interest earned by your investment. The money you deposit into your RRSP, and the revenue you earn from it, is handled in one other way than what goes into your HISA. Access your money instantly by transferring it to a linked account or using free and limitless e-Transfer. Free limitless transactions to/from your linked account, and ten free invoice payment transactions per thirty days.

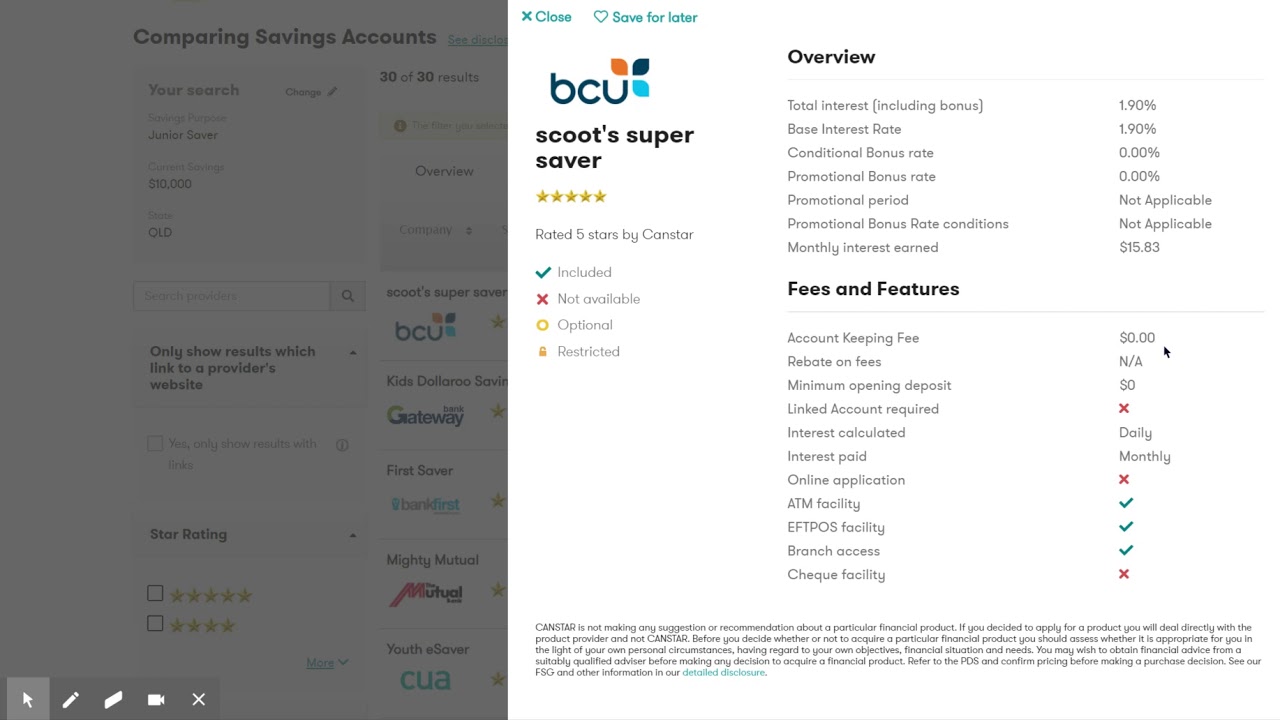

APYs are sometimes adjusted when the Federal Reserve modifications its benchmark interest rate. To fight inflation, the Fed has hiked its rate of interest several times in 2022. This has allowed banks to lift their APYs, so savers earn better rates of interest. Alliant Credit Union’s High-Rate Savings account presents a aggressive dividend fee and, as lengthy as you choose or eStatements, you won’t pay a monthly payment . There’s a $5 initial deposit to open an account, but the credit score union reimburses you for that deposit. Generally, a high-yield financial savings account doesn’t permit account holders to write checks against the account, whereas many money market accounts present check-writing privileges.

Reader Interactions

Annual proportion yield is the speed of return that your financial savings account earns. The annual share yield consists of compound interest, resulting in quicker progress. The bigger the APY on a financial savings account, the extra money you may make. Try out a free savings calculator to estimate how a lot curiosity you'll earn over a year based mostly in your savings account charges and APY. Once you add money right into a high-yield savings account, you earn curiosity. Then, that interest – which your bank will credit score you on a quarterly or monthly basis – begins to earn even more curiosity, often known as compound interest.

Like other savings accounts, the curiosity earned on enterprise savings accounts is taken into account taxable earnings and have to be reported to the IRS. A business financial savings account allows companies to maintain cash reserves available to make use of as wanted. For sole proprietors, having a enterprise savings account offers you a way to keep your small business financial savings separate from personal funds.

Salem Five Direct, Eone Financial Savings - 410% Apy

This savings account has a strong online banking platform and a highly rated cell utility. Users all have free access to on-line invoice pay and their credit score score. You can apply for membership after making a one-time $5 donation to a nonprofit that helps foster children. It is a superb high-interest savings account for cash management. This excessive yield account is finest for those on the lookout for a financial savings account with flexibility. Free cash transfers and an ATM card make it simple for account homeowners to entry and transfer their cash around accounts.

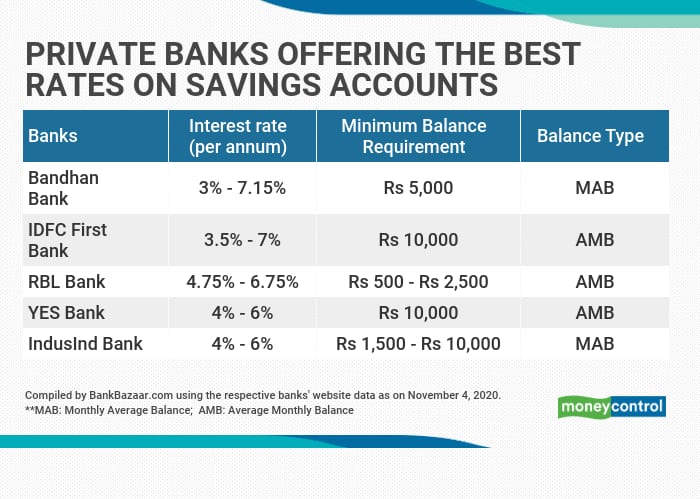

There are a couple of banks that offer you very aggressive interest rates if you make a big deposit whenever you open your account. But some banks can pay you an excellent rate of interest without requiring a large deposit. This may not be a dealbreaker if you're fortunate sufficient to have considerable property.

If you’re unable to maintain a $5,000 stability, your curiosity will drop to zero.25% APY. Marcus by Goldman Sachs is the web shopper financial institution subsidiary of Goldman Sachs that offers its prospects high-yield savings and personal loans too. USAA isn't going to provide the greatest interest rates on this record. You can get all of your insurance coverage, banking, loans, and so on. multi function place. After scouring the net and throwing in my very own private experiences.

±New deposits is the decrease amount of the rise in total deposits and increase in High Rate Savings Account Balance . 4.90% each year when your daily closing steadiness is $25K or over.

Varo additionally presents an ATM community with no charges (as well as no penalty for overdrafts as a lot as $50). For any money deposits, note that Varo solely makes these obtainable through third-party companies, which may charge a fee. Members with direct deposit earn 3.00% APY on financial savings and Vaults balances, and 2.50% APY on their checking balances.

To open this account, you should turn out to be a member of Sunova Credit Union, which requires a $5 share. Your share is taken into account an investment and is totally refundable do you have got to cancel your membership. Canada Tire’s online HISA — which the retailer has pet-named the ‘Money Magnet’ — is a stripped-down and easy-to-use account that may facilitate primary transactions.

With America presently facing a 40-year inflation high, you can see why funding a savings account that compounds curiosity is an attractive thought. Standard savings accounts only offer ~0.10% curiosity, whereas a high-yield account can earn as much as 20 occasions that fee in an APY. Interest is the money you can hope to earn along with your savings account.

You additionally don’t have to fret about paying a monthly charge or any minimal steadiness requirements. However, there are no brick-and-mortar banks to entry your accounts. To create this listing, Forbes Advisor analyzed seventy three online savings accounts at fifty three monetary establishments, together with a combine of conventional brick-and-mortar banks, online banks and credit score unions. We ranked every establishment on 12 data points inside the categories of APY, fees, buyer experience, digital banking expertise and minimum necessities. No month-to-month upkeep charges, no minimal deposit or steadiness necessities, and an APY of two.66% put TAB Bank squarely on the list of greatest high-yield financial savings accounts. TAB Bank is an online-only financial institution established in 1998 that focuses on financial savings and cash market accounts and CDs.

It’s an especially good concept to keep away from accounts with minimum steadiness requirements and charges if you open a savings account for a child. He or she is in all probability going going to be depositing small quantities at a time. You will need to act as a custodian for the account and have full access. When your baby turns 18, you could sign over your custodial rights if you wish. Not for the on a regular basis punter, a enterprise savings account permits you to earn interest on your business’s funds and keep it protected. They can usually include slightly lower rates of interest in comparability with personal accounts and may require a better minimum stability so as to earn interest.